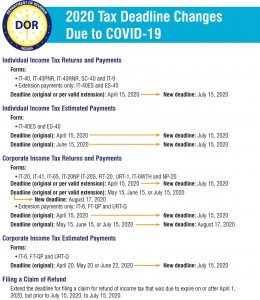

The Indiana Department of Revenue (DOR) announced additional extensions for the filing and payment of certain individual and corporate tax returns to provide further relief during the COVID-19 health crisis. These extensions are in addition to the ones previously announced on March 19, 2020.

In conjunction with the additional federal extensions provided by the Internal Revenue Service (IRS) under Notice 2020-23, DOR has extended the following Indiana deadlines:

- Individual estimated payments originally due on June 15, 2020, are now due on or before July 15, 2020.

- The deadline for filing a claim for refund of income tax set to expire between April 1 and July 14, 2020, is now extended to July 15, 2020 (including refunds of withholding or estimated tax paid in 2016).

- Corporate estimated payments due on April 20, May 20 or June 22, 2020, are now due on or before July 15, 2020.

- The corporate tax returns listed below due on May 15, June 15 or July 15, 2020, are now due on August 17, 2020. This includes forms IT-20, IT-41, IT-65, IT-20S, FIT-20, IT-6WTH and URT-1.

“Our team is constantly monitoring IRS actions and taking the steps required to help Hoosiers who may be experiencing difficulty during the COVID-19 pandemic,” stated DOR Commissioner Bob Grennes. DOR announced several other filing and payment deadline extensions in mid-March. All changes related to the COVID-19 pandemic can be found on DOR’s Coronavirus webpage at www.dor.in.gov/7078.htm.

The Whitinger team remains available to you throughout this situation. Please do not hesitate to reach out if you have questions or would like to discuss this new guidance.

We are here and ready to help.

Click the image below to download the pdf.